Compromise

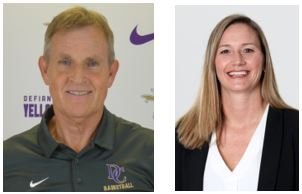

My parents and Corie’s parents recently attend the Defiance College vs Transylvania University Women’s basketball game in Defiance, OH. Nothing to do on a cold, gray Saturday in January in Northwest Ohio, eh? Not exactly. My daughter Celia went to Transylvania and played for the current coach, Juli Fulks. Juli is a fantastic leader and changed Celia’s life, teaching her leadership, analytical thinking and competition far beyond what she ever learned in the classroom. Our entire family enjoys supporting Transy and the team.

Defiance was coached by Rod Hersha. Rod was the math teacher at Napoleon High School from 1974 until 1998. Corie and I both had Mr. Hersha in class. I, in fact, had Mr. Hersha three times. I had him for Algebra 1, Pre-Calculus and Calculus.

I’m betting most of us have teachers and coaches that influenced our lives. Mr. Hersha was up near the top for me. He certainly taught me a lot of math. I learned most algebraic concepts from him along with how to prove a mathematical hypothesis. My most successful AP test result came under his tutelage. While math was his subject, like most influential people, he had strong and memorable opinions that lasted long after I forgot the specifics of sine, cosine and tangent.

I will never forget his “delayed gratification” theme, imploring us to revel in hard work and saving money, with the promise that the payoff tomorrow would be bigger and more satisfying than relaxing and spending today. He also told us how important it was to “teach someone how to fish rather than giving them the fish”. Our country continues to struggle with that concept today, and I’ve made sometimes painful decisions to teach that lesson to my children when it would be easier to hand them the fish. Finally, he talked about compromise in a marriage. I remember him telling me that you have to compromise in your marriage, using the example of accepting when your wife left the cap off the toothpaste tube knowing you might throw the towel on the floor. In my case, Corie hates unloading the dishwasher. I don’t mind doing it as long as she doesn’t mind picking my clothes off the pile I stack to the ceiling every week.

---------------------------------------------------------------------------------------------------------------

For the past 12 years, delayed gratification has been unheard of, and we haven’t had to compromise in the markets. Pick growth stocks, they go up. Buy bonds, they go up. Buy bitcoin, it goes up. However, such a scenario has never lasted in history. Any time countries print money to the degree printed in the US and around the world, inflation rears its ugly head. And that’s exactly what happened. I’ve talked about it here, and all of you reading this have felt inflation – eggs, furnace filters, gas, home prices, etc. And so the Federal Reserve raised interest rates to slow the economy and the related inflation. As I type this, the interest rate controlled by the Federal Reserve is about 4.25%, up from essentially 0% a year ago.

In 2022, that brought the markets back to earth. The S&P 500 ended the year down just shy of 20%. The US bond index was down more than 13%. This is the worst year on record for the bond market. With both the stock and bond markets getting smacked, there was nowhere to hide. The Vanguard 2025 index, which is a mix of stocks and bonds that is supposed to be the optimal mix for someone about to retire, was down almost 16%.

What does 2023 hold? Inflation is moderating, down from 9% in July to 6.5%. Most of the pundits believe the Fed is almost done raising interest rates on the belief that the previous increases will continue to bring inflation down. This is where the consensus ends. There is a camp that sees a recession coming, driven by the lightning fast move in rates. There is a camp that thinks there is still so much money sloshing around the economy that the Fed may have slowed everything just enough, without tipping the economy into recession.

My eyes see a slow-motion slowdown. I was in Florida over New Year’s and the middle to upper income end of the spectrum continues to spend. The job market remains tight. At the same time we see tech companies laying off people, while in other areas of the economy management is excited to finally be able to hire people. And market history says there’s no such thing as “it’s different this time”. One of the most widely utilized indicators is called the yield curve. It’s a chart that shows how a person generally gets a higher interest rate the longer they are willing to tie up their money. For example, if you are willing to buy a 2 year Treasury, you might get 4%. If you are willing to tie up that same money instead for 10 years, you might get 6%. You are being paid for giving up your money for longer. At the moment that rule of thumb is flipped on its head, or inverted. Generally when this inversion happens, it signals a recession is coming. At the moment, a 2-year bond pays 4.1%. A 10-year bond pays 3.4%. That’s widely considered a deep inversion.

Here is a graphical representation of normal vs inverted yield curve:

Below you can see in January of 2021 the curve was “normal”. And the current yield curve is inverted – with short term Treasuries (1 month, 3 month and 1 year) paying more than longer term Treasuries (3 year all the way out to 30 year). This usually signals recession is coming.

This is where compromise comes in. No longer can we assume growth stocks, real estate and bitcoin will all go up in a straight line. Sure, the market could go up for 3-6 months as investors grow excited that the Fed is going to stop raising rates. But generally, we need to get a bit more creative. We feel the need to compromise between wanting huge returns but recognizing that the risk to achieve those returns has gone up dramatically. This is where we continue to beat the drum for several key categories of assets:

1. We might not have been first, but we were certainly early to get into Treasuries. We still see short-term Treasuries as a fantastic place to hide out. Today, 3-month Treasuries yield 4.6%, 6-months are at 4.8% and 12 months at 4.7%.

2. Dividend paying stocks. Companies that pay dividends are healthy cash flow generators and generally do better than the average stock in these times.

3. Health care stocks. We continue to believe that the pace of innovation in health to fight diseases and the obesity epidemic will drive health care stocks.

We all want to have our cake and eat it too. Compromise feels like settling. It could easily feel like defeat. But the Fed recognized that not compromising led to the spike in inflation and a hit to our standard of living. Over the next couple of years, I suspect we will all need to compromise to realize a decent return to avoid the risk of a big loss. Ultimately that will lead to delayed gratification when we have more money to invest when the next bull market rises.

For those of you who will have us do your taxes, we will be in touch in the this week.

Jared

What’s Your Financial Story?

Brian Kellett, brian@kellettschaffner.com. Phone 513-312-6067

Dave Bodnar, david@kellettschaffner.com. Phone 513-258-6973

Jared Kline, jared@kellettschaffner.com. Phone 513-768-2238

Kellett Wealth Advisors LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Kellett Wealth Advisors LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Kellett Wealth Advisors LLC unless a client service agreement is in place.