FUNkle Johnny

Napoleon through…. Edgerton, Butler, Waterloo, Kendallville, Nappanee, Bremen. And finally SR 31 North to South Bend. The trip took FOREVER. Napoleon, OH to the west side of South Bend was the journey to see Grandma and Grandpa. We took State Route 6 and it passed through all these little towns. And Javan and I typically sat in the third row in the Caprice Classic station wagon. We faced backward. It was a brutal ride. Lots of kids in the car. We were at the mercy of how cold/warm dad wanted the temperature. There were two things that made the trip bearable - one, grandma’s Polish sausage, corn, mashed potatoes; and two, Uncle Johnny.

Uncle Johnny is mom’s youngest brother. He’s 14 years older than me. And he lived at home into his mid-20’s so he was home when we made the trip into my teenage years.

Today I’m an uncle to 11 nephews and nieces. And I enjoy having fun with them. But I pale in comparison to FUNkle Johnny. He did it all. He took me to play par 3 golf. We watched alot of movies, many of which I probably shouldn’t have watched at that age. When we visited on a weekend, we would go to the South Bend Motor Speedway and watch these “super modified” car races. It was called a “speedway”, but it was more like a field with a track on it. And we were probably 10 rows from the track. So the sound and fury of those cars was right in front of us. He also took me to old Comiskey Park on a charter bus, my first and only baseball game at that historic park.

I’m also a sucker for a hearty laugh. I love laughter and enjoy another person’s laugh. Johnny has it. I watched Blue Brothers, alot of early Saturday Night Live, those silly 70s kung fu movies where the dubbing was off - all with Johnny. Even if I was too young to understand the joke, I laughed when he laughed.

All of that said, arguably my favorite memory was playing video games with him. It’s safe to say that he introduced me to those earliest games. He had an Atari and played everything from Space Invaders to Night Driver (car racing game) to Pac Man. I played some and was entranced by competing to win. I also enjoyed watching him play. I got to stay up way past my bedtime, often to midnight, mesmerized by that screen. It’s not a stretch to say Uncle Johnny introduced me to what today is being called Artificial Intelligence or “AI”. Those early games were so rudimentary that it would be easy to dismiss them as a different world. But they were the early ancestors of the complexity and sophistication of today’s games. They were the first electronic addiction, before social media. And, in my opinion, they paved the way for today’s data mining that enables large computer systems to find the data we want and present it to us for knowledge, research and decision-making. Those early games were often played by the people who are now running the large tech companies. I have FUNkle Johnny to thank for my connection to that world.

—--------------------------------------------------------------------------------------------------------------------------------

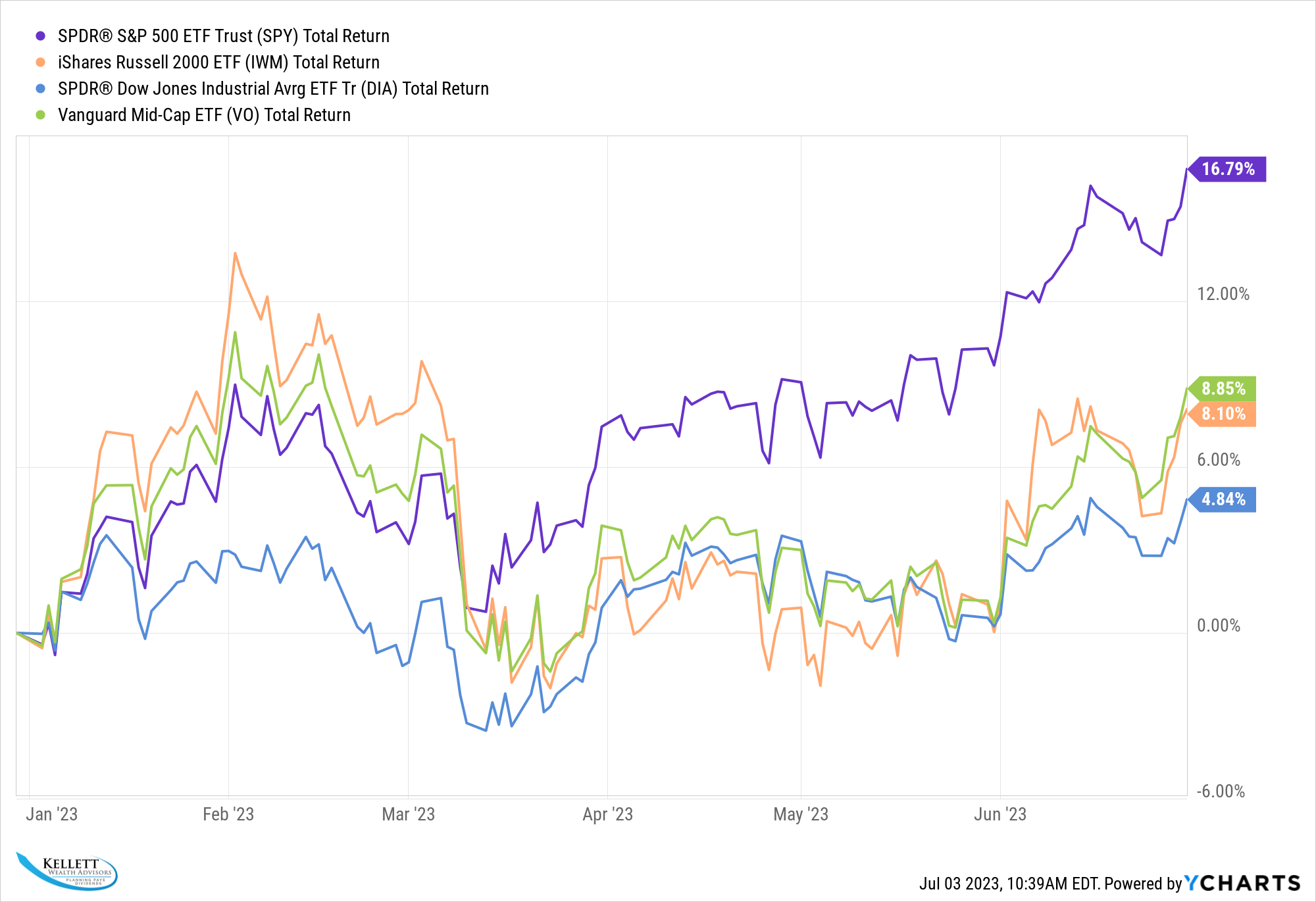

It’s been a couple months since I talked extensively about the market. You may recall that my last article was about the debt ceiling. Luckily, cooler heads prevailed and that is now in the rear view mirror. And while the media would love to spend the next 18 months talking about the next Presidential election, it’s worth taking a month to talk about the here and now. As I write this, the first half of 2023 is in the books. And it’s been quite a half for at least part of the market. As you can see, from that chart, the S&P 500 is up 16% for the first half of the year! It has far outpaced small caps (Russell 2000), Midcaps and the Dow Jones. This is quite unique. Over the past 50 years, small and midcaps have both outperformed the S&P.

Major Index Returns 2023 Year to Date

It doesn’t tell the whole story. It’s also informative to look over 18 months. When we do that, we see that everything is actually down, with small and midcaps trailing over that period as well. The good ole’ Dow Jones is actually the winner of that timeframe, but still down.

Major Index Returns, 2022 and 2023 YTD

So what’s going on this year? For one, inflation is coming down quickly:

But most of the story is “AI”. Artificial Intelligence is the buzzword of the year. Microsoft introduced their natural language search tool, Nvidia has chips that power the revolution and just about every technology company is talking about how AI is going to change the world. Here’s a chart that will blow you away - the chart below shows 3 S&P sectors all delivering 30+% this year with no other sector above 10%. Two of the 3 sectors - Technology Select, Communication Services - are all about technology and the AI revolution. The third of the 3 standout performers is “Consumer Discretionary”. The top two holdings in this sector are Tesla and Amazon, both of which are as much about technology as anything else they do.

S&P Sector Performance Year to Date

I’m not going to explain AI in total. Frankly, I’m still trying to figure it out. But I do have one example that I’ve personally experienced. If you’ve ever used a search engine like Google, you know that you type in something you want to search and Google brings back a list of links. You then have to sort through the links and pick the one that looks like it has the best solution to your search. An AI enabled search engine brings you back the answer rather than the list of links. In a sense, it skips the middle man - the links. It is expected this concept will sweep the technology world and usher in a whole new level of automation and self service as the Internet did 25 years ago and as phones did 15 years ago.

There are storm clouds on the horizon, as there often are. The following chart shows jobless claims and their relation to the economic cycle. I follow a chart guy who tracks everything under the sun. As you can see from the chart below, his analysis shows that a recession arrives when claims reach about 350,000 (recessions are the green shaded columns). His current estimate is for that to happen in about December. We will keep an eye out for that prediction.

Unemployment Claims

Until then, we expect the technology trend to rule the day. The technology revolution, as it has for 50 years, powers productivity and innovation. And that leads to profits across many industries including automotive, health care and financials. As such, the market will continue to be driven by tech and all its tentacles.

If you type in FUNkle in an AI enabled search engine, who knows, it may just come back with the answer: Johnny Wojciechowski.

Jared

What’s Your Financial Story?

Brian Kellett, brian@kellettschaffner.com. Phone 513-312-6067

Dave Bodnar, david@kellettschaffner.com. Phone 513-258-6973

Jared Kline, jared@kellettschaffner.com. Phone 513-768-2238

Kellett Wealth Advisors LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Kellett Wealth Advisors LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Kellett Wealth Advisors LLC unless a client service agreement is in place.