Dr. Roy Swank, STAT!

10 years ago this week, we got some awful news. Debilitating news.

At the end of July, 2013, we took a road trip through New York. We hit Cooperstown and then ended up in New York City. Had a great time taking in the sites and sounds of Manhattan. We stayed in New Jersey (it was cheaper) and went into the city each day for the various activities – Mets game, Broadway show, walking tour of Midtown, among others. This was during the TV run for “Cake Boss”, so we even drove to Hoboken for a glimpse of Buddy Valastro. Clearly, I got over-ruled by the women in my life.

We got home and life was normal. Corie and I played tennis the next evening and went to bed. Corie woke up in the middle of the night and couldn’t feel her left arm and leg. Dead weight. And she had a tingling sensation in her chin. Due to a previous back issue, she went to Beacon Orthopedic. I got the call that they were doing a brain MRI and knew something wasn’t right so I stopped what I was doing and headed to Beacon. The doctor had the bedside manor of the chair and told us it was likely a “metabolic issue”. After a couple visits with the neurologist at UC Medical Center, a trip to the Cleveland Clinic and a spinal tap, Corie was diagnosed with Multiple Sclerosis, or MS.

MS is a progressive disease that slowly disables the body by causing the body’s immune system to attack nerve fibers, resulting in communication problems between the brain and the rest of the body.

Corie and I spent the next six weeks grieving. We also got to work figuring out the cause and how to land on the best possible quality of life outcome. Over the course of many Internet searches, we found one name that kept coming up. Dr. Roy Swank. Dr. Swank was a neurologist who treated MS patients for 50 years in the Portland area. While all kinds of causes had been bandied about – Vitamin D deficiency, exposure to viruses, and gene mutation, to list a few – Dr. Swank concluded that a primary driver was diet. Specifically, diets full of saturated fats were causing an inflammation in the body. Dr. Swank did studies both from his practice in the Northeast as well as different regions of Norway. The regions where people ate a higher content of animal and butter fat had greater prevalence of MS.

Corie and I made significant changes to our diet. We cut out red meat, opting instead for chicken, turkey and fish – try Corie’s turkey lasagna and tell me you miss the ground beef! We moved to skim milk, switched our butter, and, much to Corie’s chagrin, all but eliminated ice cream. We also embarked on an overhaul of our fitness. Today, 10 years later, we still eat the low saturated fat diet. And we still prioritize strength and cardio training. I have to knock on wood since who knows what tomorrow will bring…. But Corie is 10 years removed from the diagnosis and she is still healthy as ever. In fact, my basketball team will be quick to tell you the form on her push-ups is far better than mine.

—--------------------------------------------------------------------------------------------------------------------------------

Like a doctor’s harsh diagnosis, last week the Fitch Ratings company downgraded US debt to AA+ from AAA. Fitch’s explanation of the rating downgrade is this: “The downgrade reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to AA and AAA rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions”.

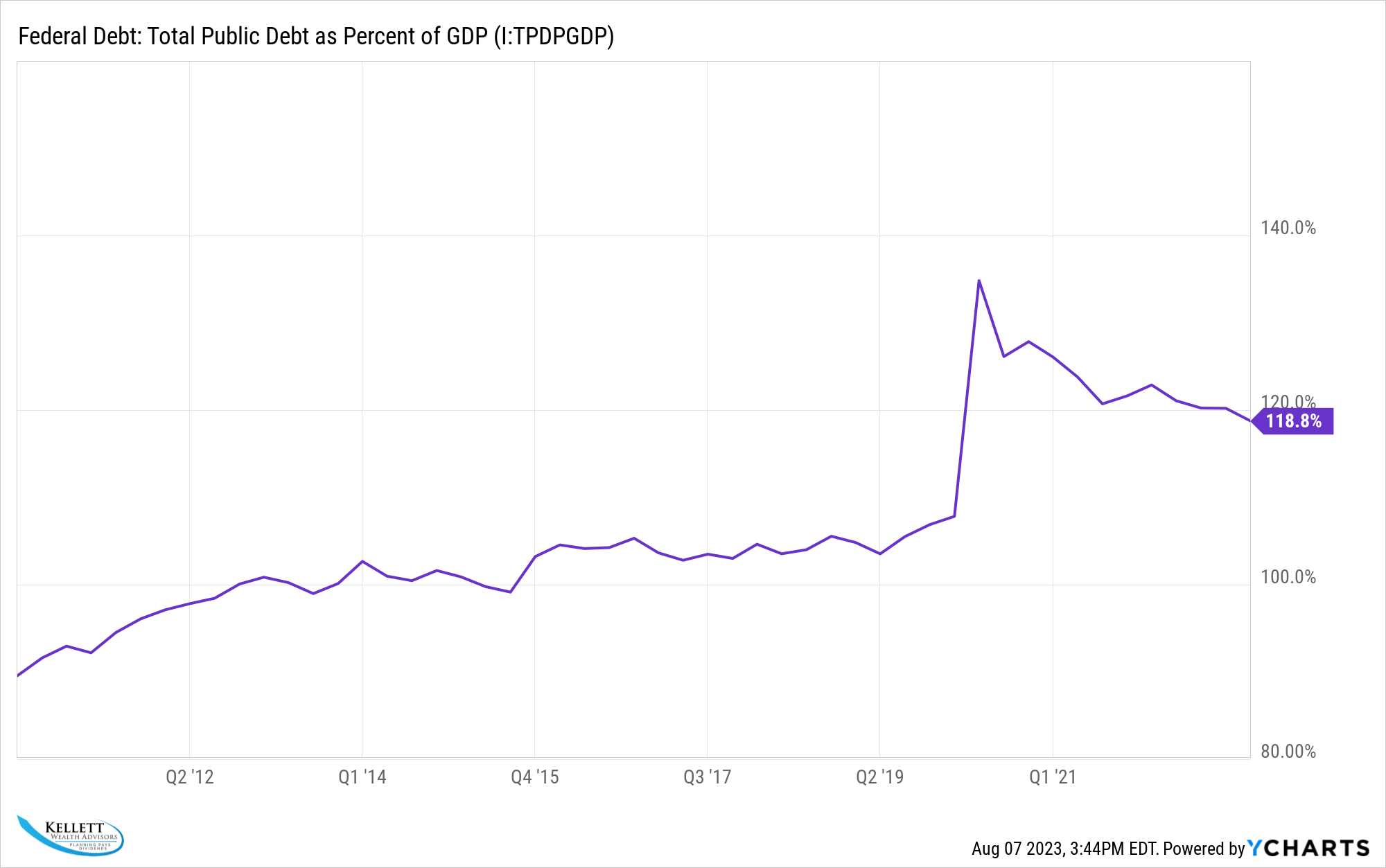

In 2011, Standard & Poor’s dropped its AAA rating on US debt while Fitch stood pat. I’ve included two charts below – the first one that goes back to the 1960’s. You can see that the US debt as a % of what we produce (GDP) has ballooned. S&P downgraded when the ratio reached the 80-90% range.

As you can see from the second chart (below), Fitch is essentially reacting to the latest jump, from the 100% range into the 120’s. Fitch also referenced the country’s ongoing inability to make systemic changes.

When does this cause us problems? It may feel like a stretch to do, but I think of debt as a complex, debilitating, progressive disease. Everything seems fine until one day it isn’t. And just as lots of scientists and doctors battle over the root causes and solutions to a disease like MS, politicians, opinion columnists and economists battle over the root causes and solutions to our debt issue. For now, it all seems academic. We spend more and the chart looks worse. But the economic repercussions aren’t terribly obvious. And politicians don’t want to look stupid. So the concept of a default, or even a “great reset” which is talked about in certain circles, seems far-fetched to me. More likely, I think, is more inflation. We are currently in a period where Fed Chair Powell is raising interest rates and the inflation genie is being put back in the bottle. But with more debt and higher interest rates come more interest payments.

As soon as victory is declared over inflation, lower interest rates and more printed money may be on the agenda. The government will print more money to pay down the debt. The outcome is likely more inflation. As we’ve seen, this inflation destroys purchasing power of everything from toilet paper to cars. And every establishment pushes us for more tips. We keep spending more and more. Just look at Social Security, Medicare and Discretionary Spending:

As long as this continues, our debts will continue to grow. We risk more ratings downgrades, inflation and the potential for a weaker standing on the world stage. We need a new spending diet and some exercise before our economy and livelihoods are debilitated. Time to call Dr. Swank. STAT!

Jared

What’s Your Financial Story?

Brian Kellett, brian@kellettschaffner.com. Phone 513-312-6067

Dave Bodnar, david@kellettschaffner.com. Phone 513-258-6973

Jared Kline, jared@kellettschaffner.com. Phone 513-768-2238

Kellett Wealth Advisors LLC is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Kellett Wealth Advisors LLC and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Kellett Wealth Advisors LLC unless a client service agreement is in place.